The moment ABTC went public, it sent waves through the market—more than just a financial debut, it was a high-stakes mix of politics, crypto, and capital.

A Public Debut: ABTC Rings the Bell

On September 3, 2025, American Bitcoin Corp. (Ticker: ABTC) officially debuted on Nasdaq. Founded by Donald Trump Jr. . and Eric Trump, the company merged with Canadian miner Gryphon Digital Mining via a full-stock acquisition, with Hut 8 holding the majority stake. The merger quickly transformed ABTC into a hybrid platform combining bitcoin mining and treasury holdings.

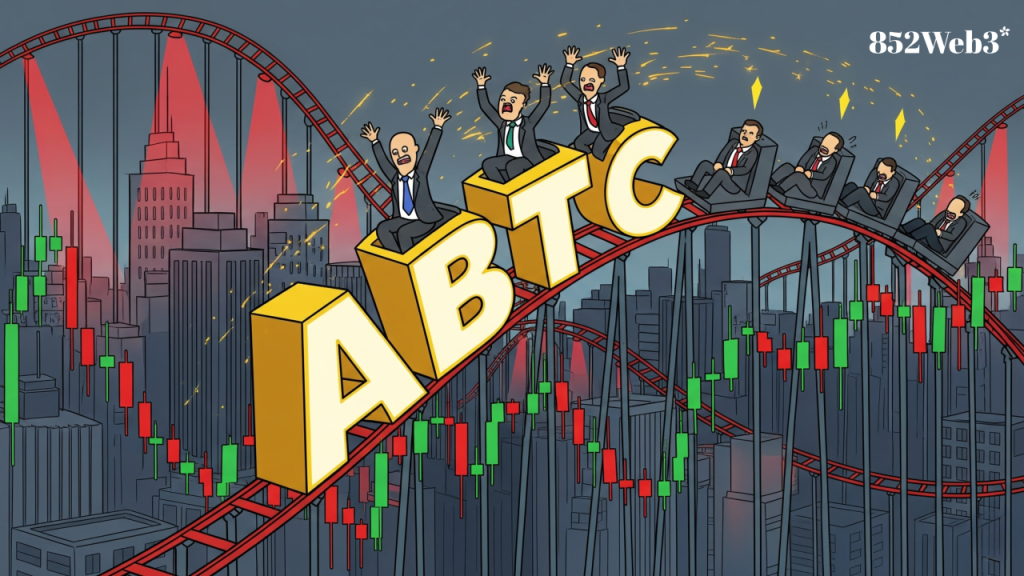

Market Rollercoaster: First-Day Frenzy

ABTC’s debut saw dramatic swings: shares soared as much as 110%, reaching an intraday high of $14.52 and pushing market capitalization past $7 billion. Prices later retraced, closing around $8.04- still a 16.5% gain over the IPO price. Volatility triggered multiple trading halts, highlighting both the market’s excitement and uncertainty around the politically-backed crypto venture. The opening day became a hot topic across financial media and crypto communities, signaling potential continued fluctuations ahead.

Big Players, Bigger Gains: Family Stakes Soar

The Trump brothers collectively hold roughly 20% of ABTC. At peak prices, their paper wealth surged over $2.6 billion, with closing valuations still around $1.5 billion. The recent launch of the WLFI token (World Liberty Financial) further amplified the family’s financial footprint, with paper gains hitting $5 billion and actual cash-outs around $500 million. This move underscores how political influence, social reach, and capital strategies can converge to create rapid wealth expansion, drawing market attention to ABTC’s underlying power dynamics.

Treasury Strategy: Bitcoin at the Core

From day one, ABTC adopted a treasury-like approach, amassing 2,443 BTC- valued at roughly $270 million-placing it among the largest publicly listed bitcoin reserves. Leveraging Hut 8’s mining and energy infrastructure, ABTC maintains scale advantages in both bitcoin mining and acquisition. Donald Trump Jr. shared on X that the company aims to build the largest bitcoin treasury in the U.S., restoring transparency and trust to the financial system, declaring: “America’s new era of bitcoin starts now.” This blend of asset accumulation and public listing positions ABTC as a platform where bitcoin is not just an asset, but a strategic centerpiece.

Political Spotlight: Controversy in the Mix

ABTC’s rise is inseparable from the Trump family’s political influence. Analysts note the company is highly sensitive to media scrutiny and political narratives, sparking debates about ethics, governance, and potential conflicts of interest. While Eric Trump claims their father is “completely uninvolved” and that his own role is mostly public-facing, the market remains alert to how political visibility may affect investment risk. This mix of politics and capital underlines both opportunities and complexities in ABTC’s story.

Looking Ahead

Where does ABTC go from here? Will the stock stabilize? Can the bitcoin treasury strategy hold?