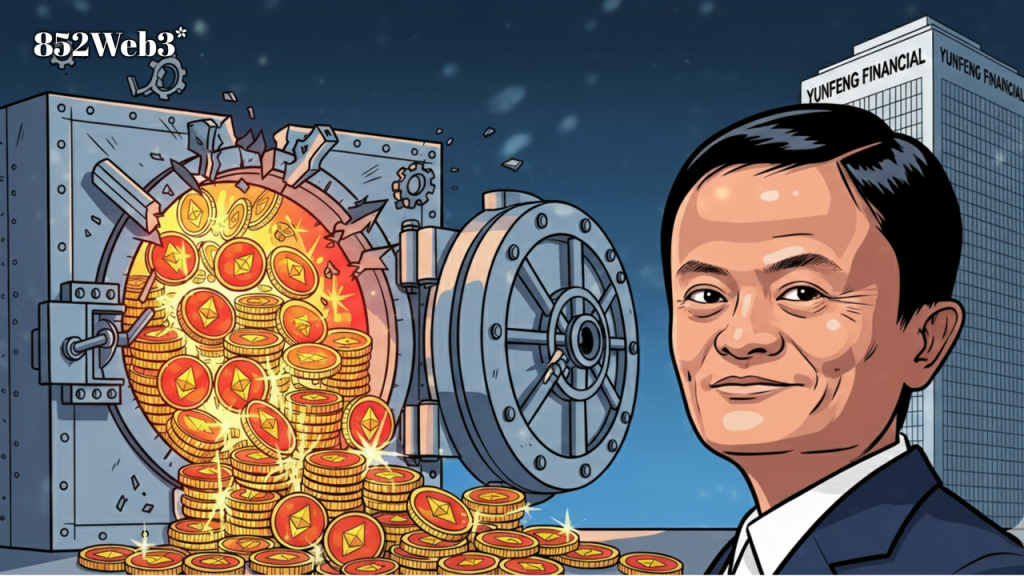

Yunfeng Financial Group, a Hong Kong-listed financial services firm with ties to Alibaba Group founder Jack Ma, has acquired 10,000 Ethereum (ETH) for approximately $44 million. This move marks a significant step in the company's expansion into Web3 and digital asset sectors.

From Reserve Asset to Web3 Engine: The Strategic Importance of ETH

In early September 2025, Yunfeng Financial Group announced the acquisition of 10,000 ETH, funded entirely through its available cash reserves. The company plans to classify these holdings as investment assets in its financial statements. This acquisition aligns with Yunfeng's broader strategy to explore frontier areas, including Web3, Real-World Asset (RWA) tokenization, digital currency, and artificial intelligence (AI). The ETH holdings are expected to support RWA tokenization, technological innovation, and the integration of finance with Web3 infrastructure.

Jack Ma's Indirect Influence: A Subtle Signal to the Financial Sector

While Jack Ma does not directly manage Yunfeng Financial's day-to-day operations, his influence is evident. Through Yunfeng Capital, a private equity firm co-founded by Ma in 2010, he holds a significant stake in Yunfeng Financial. This indirect involvement suggests a strategic interest in the company's ventures into digital assets and Web3 technologies.

Market Response: Cautious Optimism

Following the announcement, Yunfeng Financial's stock price experienced a modest decline of approximately 4.1%. This reaction indicates a cautious approach from investors, possibly due to the inherent volatility and regulatory uncertainties associated with digital assets. However, the strategic intent behind the acquisition is clear, and the market may take time to fully appreciate its long-term implications.

A Broader Trend: Institutional Adoption of ETH

Yunfeng Financial's move is part of a growing trend among institutional investors adopting Ethereum as a strategic asset. Companies such as BitMine Immersion Technologies, SharpLink Gaming, The Ether Machine, BTCS Inc., and BlackRock have also increased their ETH holdings, viewing it as a key component of their digital asset strategies.

Looking Ahead: A Quiet Transformation

Yunfeng Financial's acquisition of 10,000 ETH is more than a financial transaction; it's a strategic move towards integrating blockchain technologies into traditional finance. As the company explores applications in insurance, asset management, and decentralized finance, this acquisition may serve as a catalyst for broader adoption of digital assets in the financial sector. The industry's trajectory suggests that such strategic moves will become increasingly common as blockchain technologies continue to mature.