When the world’s largest stablecoin issuer sets its sights on the U.S. market, the balance of regulatory and crypto power may be shifting.

💰 A New Era for Stablecoins

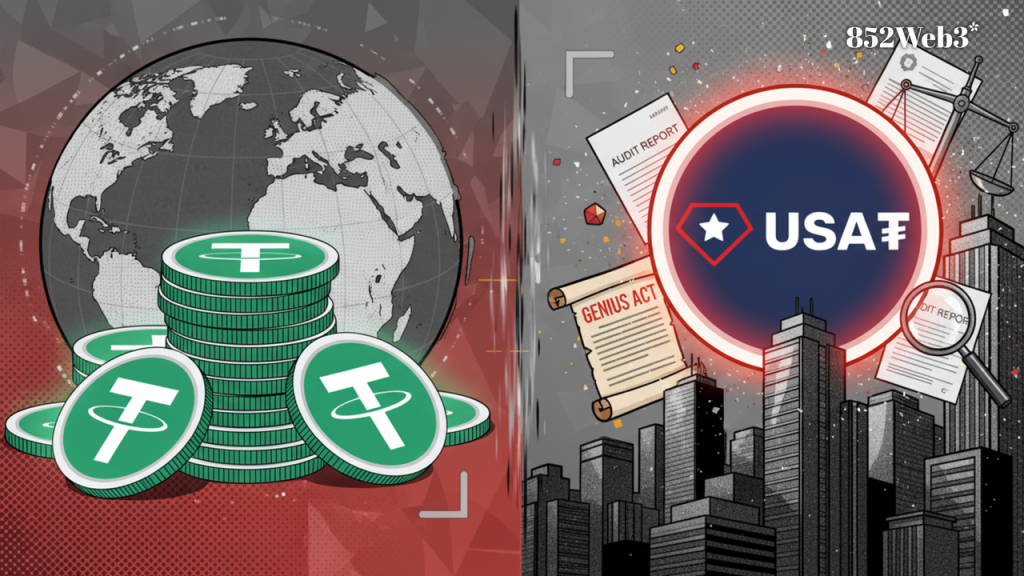

Tether announced it will launch a new U.S. dollar stablecoin, USAT (USA₮), by the end of 2025. Unlike the widely used USDT, USAT is designed to fully comply with the GENIUS Act, the first comprehensive U.S. regulation for stablecoins passed in July 2025.

USAT will be issued through Anchorage Digital Bank, a federally licensed trust bank, with reserves held by Cantor Fitzgerald and subject to regular audits and disclosure requirements. This positions USAT as Tether’s first fully regulated entry into the U.S. market.

Tether CEO Paolo Ardoino commented: “USAT reflects our commitment to ensure the U.S. dollar thrives in the digital era, while providing transparency and trust to our users.”

🌐 USDT vs. USAT

This move isn’t a “rebrand”- it’s a dual-track strategy.

USDT will continue circulating internationally, while USAT targets U.S. residents, fully adhering to domestic regulations. Tether is effectively creating two stablecoin ecosystems under the same brand: one for global markets and one for U.S.-regulated use.

The strategic intent is clear: the U.S. is the world’s largest capital market with strict oversight. Launching USAT demonstrates Tether’s willingness to embrace regulation, respond to transparency concerns, and compete directly with U.S.-based stablecoins like USDC.

🛡️ Compliance in Focus

Under the GENIUS Act, U.S.-issued stablecoins must be backed by cash or U.S. Treasuries and provide monthly reporting and annual audits. This not only boosts transparency but also aligns stablecoins more closely with traditional financial rules.

Industry reactions have been mixed. Some view USAT as Tether’s strategic compliance step to maintain market leadership, while others wonder whether Tether can preserve its operational flexibility under stringent U.S. oversight.

Expanding Footprint & Looking Ahead

USAT’s U.S. operations will be based in Charlotte, North Carolina, with Bo Hines, former Executive Director of the White House Crypto Advisory Committee, as CEO.

Bo Hines stated: “We expect exponential growth over the next 12–24 months. USAT isn’t just about compliance- it’s about strengthening trust in the dollar within digital assets.”

Yet questions remain:

- Will USAT launch smoothly by year-end?

- Will institutions and users prefer USAT over the liquid, established USDT?

- Will U.S. regulators eventually require offshore stablecoins like USDT to comply with the GENIUS Act?

These factors could shape the trajectory of the U.S. stablecoin market and spark broader discussion in the crypto community.

A Turning Point for Stablecoins

USAT signals a new stage in stablecoin evolution: moving from decentralized, flexible issuance toward regulated transparency. For Tether, this is both a challenge and an opportunity. As compliance becomes the new competitive frontier, the stablecoin landscape may be poised for a significant shake-up.

💬With USAT entering the market as a fully regulated stablecoin, how do you see adoption evolving among institutions and users?